Fifty-six per cent of Canadians would switch insurers to save $150.

Fifty-six per cent of Canadians would switch insurers to save $150.

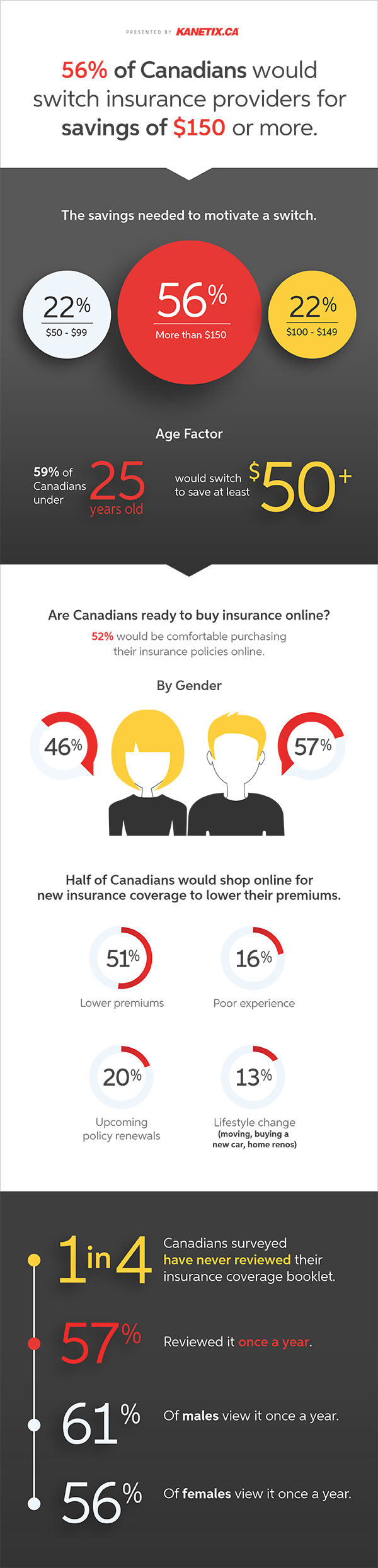

If you could save $150 on your premiums, would you be willing to switch insurance providers? According to a recent Kanetix.ca survey, most Canadians would. The survey found that 56 per cent of respondents would be motivated to break up with their current insurer for savings of $150 or more with another.

For many Canadians however, the tipping point is even lower. The survey found that 22 per cent would consider switching for savings of just $50 to $99, while another 22 per cent would make the move for savings of $100 to $149.

Whatever the incentive is to switch insurance providers, with auto insurance rates increasing in many provinces (especially Ontario), drivers are encouraged to take a closer look at their policies and compare rates for potential savings.

Beyond premiums: What drives Canadians to shop around for new coverage?

While the prospect of lower premiums primarily drives Canadians to shop around for new coverage (51 per cent), the survey also found that:

- 20 per cent are motivated to shop around when it's time to renew an existing policy;

- 16 per cent are motivated after having a poor experience with a claim or renewal; and,

- 13 per cent will shop around after moving, buying a new vehicle, or completing a home renovation.

But are we ready to buy our policies online?

Yes. Overall, more than half of Canadians (52 per cent) said they would be comfortable purchasing an insurance policy online. However, men (57 per cent) are more at ease with this idea than women (46 per cent).

Anecdotally, these results are similar to the percentage of policyholders who say they review their policy coverage booklet(s) on an annual basis: 57 per cent. One in four Canadians (27 per cent), however, admit that they've never reviewed their policy booklet and rely solely on their insurance provider for coverage details.

Compare quotes today to save

Traditionally, the two insurance policies that cost Canadians the most are auto insurance and home insurance. Combined, these two policies will likely cost you upwards of a couple thousand dollars each year. The premiums you pay, however, could be lower but only if you shop around. Compare quotes today at Kanetix.ca to find savings that will have you switching from spending more to saving more.