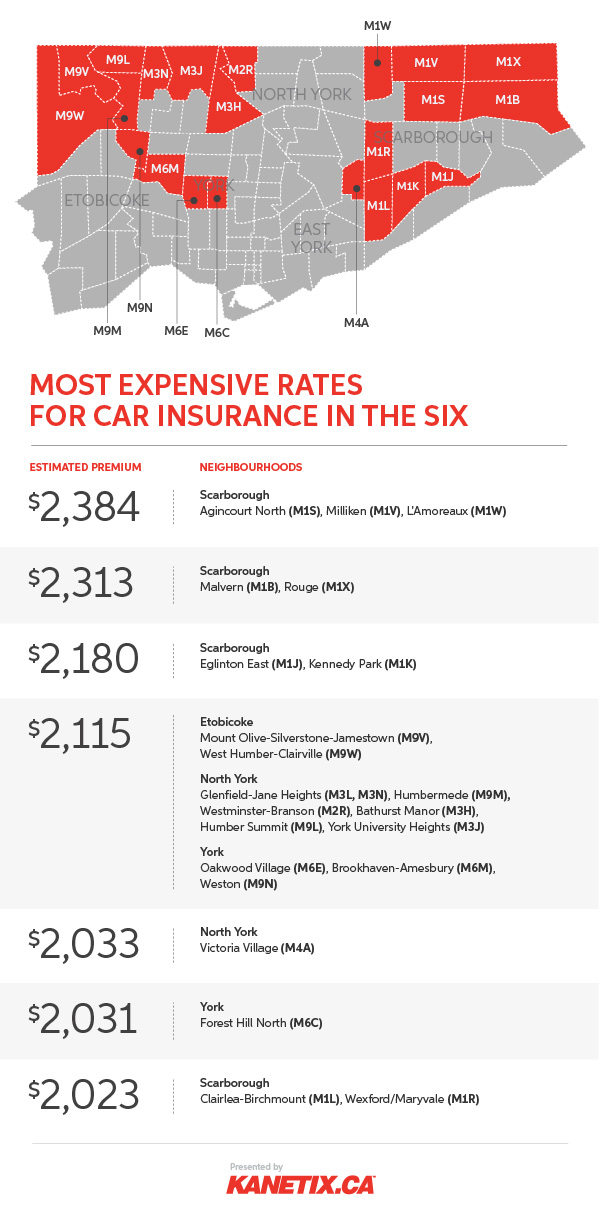

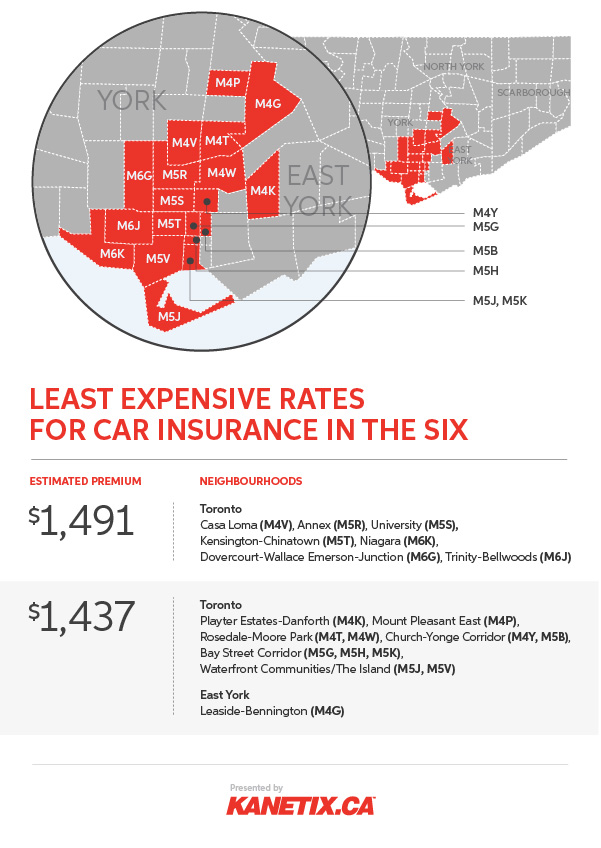

Depending on where you live in the city, you could be paying as much as $947 more for auto insurance than your fellow Torontonians.

If you live in the north end of the city, whether it's the east end or west end, chances are you're paying more for your car insurance than those living in the city's centre and midtown. In fact, chances are you're paying in the range of $2,000 to $2,400 per year for your coverage.

Average auto insurance rate in Toronto

Kanetix.ca's InsuraMap lets you compare auto insurance rates from across the city to see where the most expensive areas for auto insurance in Toronto are, as well as those areas where auto insurance premiums appear to be cheapest. What does InsuraMap show us about car insurance premiums in Toronto? First, it tells us that the estimated average annual Toronto car insurance rate to be about $1,743, but it also shows there is a huge range in rates depending on where in the city you live. And compared to the provincial average ($1,316), Toronto auto insurance rates as a whole are about 32 per cent higher.

More drivers on the road? Higher rates?

According to the city's Vision Zero Road Safety Plan , residents living in Etobicoke/York, North York, and Scarborough use their vehicles considerably more to get around, than those living in the city's core or East York. It's estimated that in Etobicoke/York, 70 per cent of residents use their vehicle to get around, and in North York and Scarborough 65 per cent do (versus taking public transit or cycling/walking.) In contrast, 32 per cent of residents living in the core or in East York regularly rely on their vehicle to get around. Most, 37 per cent, choose public transit or cycle/walk (31 per cent).

What affects your auto insurance rate?

Where you live has a direct impact on your rates. Some neighbourhoods may have higher levels of auto theft, while others may contain intersections that are more prone to collisions. As a result, insurance companies study statistical data on claims frequency (and severity), and if, collectively, an area is more likely to report claims this will be factored into a driver's rate.

In addition to where you live, your personal driving record and insurance history also have an impact, as does the type of vehicle you drive, your annual kilometres driven, your commute, and other variables such as the age and experience of any additional drivers on the policy.

Together, all of these factors go into determining your car insurance premium. However, no two insurers are the same, which is why drivers are encouraged to shop around for car insurance and compare rates. A better deal is often waiting around the next bend.

You are probably paying too much for car insurance

No matter where you live in Toronto, chances are you are probably paying too much for your car insurance coverage. And just because you live in an expensive city doesn't mean you have to pay expensive rates. The following tips will help you spend less on your auto insurance premiums:

- Maintain a clean driving record.

- Bundle your auto insurance and home insurance policies to see savings of 5 to 15 per cent.

- Install winter tires and save up to 5 per cent.

- Increase your deductibles and save up to 10 per cent; just make sure you can cover the amount in the event of a claim.

- Pay your premiums annually, in one lump sum, instead of monthly to avoid the extra fee that many companies charge to administer payments each month.

Lastly, one of the best ways to ensure you're getting the best car insurance rate possible is to shop around. It is absolutely one of the easiest ways to save. We shop the market to help you find the lowest rate and no one compares as much of the market as we do. Compare car insurance quotes today at Kanetix.ca.

Updated annually with the latest insights from InsuraMap.